Sponsored Assets - Closed for investments

LORGAVEN Apartments @ Jonesboro Rd, Atlanta, GA

- Asset Category : Residential

- Asset Type : Multifamily

- Investment Type : Common Equity Returns

- Total Lot Size : 3.26 Acres

- Estimated Total Project Costs : $15.50 MM

- Investment Strategy : BUY-BUILD-HOLD

Project Highlights: Urban Style Class-A, 84 Multifamily apartments designed to be built with contemporary layouts, eco-friendly, and technology adaptable configurations. Rooftop Solar Panels across the complex for potential reduction in tenant electric bills. Apartments will be installed with High-Speed Fiber Optic cables ready for immediate internet connection.

New Summer Grove Apartments

- Asset Category : Residential

- Asset Type : Multifamily

- Investment Type : Common Equity Returns

- Current Market Value : $4.50 MM

- Estimated Total Project Costs : $3.70 MM

- Investment Strategy : BUY-FIX-HOLD

Summit Avenue

- Asset Category : Residential

- Asset Type : Multifamily

- Investment Type : Common Equity Returns

- Current Market Value : $2.00 MM

- Investment Strategy : BUY-FIX-HOLD

Lackawanna Avenue

- Asset Category : Residential

- Asset Type : Single-Family

- Investment Type : Common Equity Returns

- Current Market Value : $1.00 MM

- Investment Strategy : BUY-FIX-HOLD

Belmont Avenue

- Asset Category : Residential

- Asset Type : Multifamily

- Investment Type : Common Equity Returns

- Current Market Value : $1.70 MM

- Investment Strategy : BUY-FIX-HOLD

Featured Assets - Open for investments

LORGAVEN Solar Energy Project 1(LSEP I)

- Asset Category : Commercial

- Asset Type : Solar Farm

- Investment Type : Common Equity Returns

- Total Lot Size : 52 Acres

- Estimated Total Project Costs : $15.00 MM

- Investment Strategy : BUY-BUILD-HOLD

SantaRosa Apartments @ Sebring, FL

- Asset Category : Residential

- Asset Type : Multifamily

- Investment Type : Common Equity Returns

- Total Lot Size : 1.54 Acres

- Estimated Total Project Costs : $1.50 MM

- Investment Strategy : BUY-FIX-FLIP

Project Highlights: Complete renovation of shutdown - 17 units of Single/Double Bedroom and New 24 units of Multifamily apartment buildings.

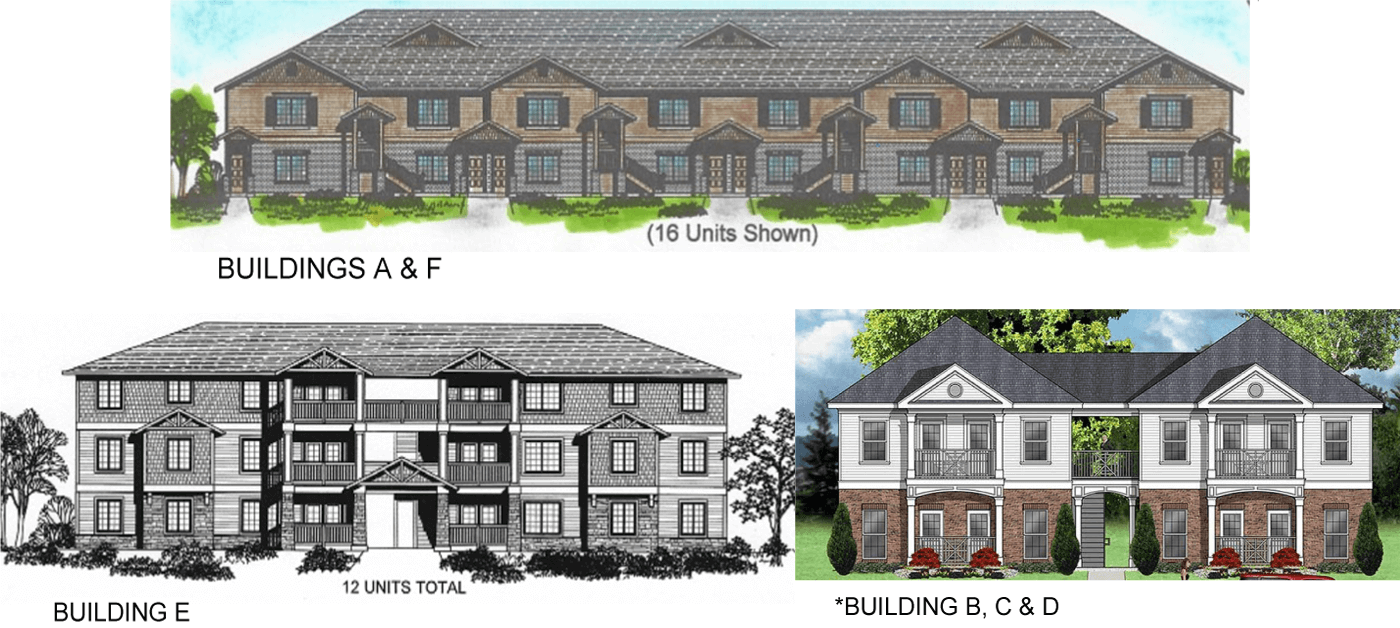

LORGAVENS Multifamily Apartments - Tunica - Mississippi

- Asset Category : Residential

- Asset Type : Multifamily

- Investment Type : Common Equity Returns

- Total Lot Size : 54.5 Acres

- Investment Strategy : BUY-BUILD-HOLD

Project Highlights: The business plan is to build 200 units Multifamily apartment complexes in 2 phases and a 250,000 sq ft flex space for Industrial warehousing and to build a Cricket Stadium.

LORGAVEN Industrial Warehousing - 1 Million SFT Flex Space

- Asset Category : Commercial

- Asset Type : Industrial Warehousing

- Investment Type : Common Equity Returns

- Total Lot Size : 52 Acres

- Estimated Total Project Costs : $17.00 MM

- Investment Strategy : BUY-BUILD-HOLD

Project Highlights: The business plan is to build 1 Million SFT Flex Space which will be for industrial warehousing purposes.

LORGAVEN Apartments @ City of San Pablo Downtown, CA

- Asset Category : Residential

- Asset Type : Mixed Use - Multifamily & Commercial

- Investment Type : Common Equity Returns

- Estimated Total Project Costs : $35.32 MM

- Investment Strategy : BUY-BUILD-HOLD

Project Highlights: New Construction of Modern Urban style designed 91 Mixed-Use Multifamily Apartments with Commercial Retail Space on the ground floor right across the City Center, San Pablo downtown in CA. This will include a commercial parking lot with 121 spaces serving tenants and the City shoppers

LORGAVEN Resort Community at Helendale

- Asset Category : Residential

- Asset Type : SingleFamily-TownHome-MultiFamily Community

- Investment Type : Common Equity Returns

- Total Lot Size : 264 Acres

- Estimated Total Project Costs : $250.00 MM

- Investment Strategy : BUY-BUILD-SELL

Project Highlights: The business plan is to build a residential community of 970 Single Family homes, Townhomes, and Multifamily apartment complexes . Solar Panels and High-Speed Fiber Optic Cables will be installed for every home and apartment.

LORGAVEN Apartments, Midtown Oakland, CA

- Asset Category : Residential

- Asset Type : Multifamily

- Investment Type : Common Equity Returns

- Investment Strategy : BUY-BUILD-HOLD

Project Highlights: Urban Style Class-A, 44 Multifamily apartments designed to be built with contemporary layouts, Eco-friendly, and technology-adaptable configurations. Roof Top Solar Panels and High-Speed Fiber Optic cables are installed across all the apartments ready for immediate internet connection.

110 Rooms CAMBRiA Hotel

- Asset Category : Commercial

- Asset Type : Hospitality - Hotels

- Investment Type : Convertible Debt Returns

- Estimated Total Project Costs : $19.00 MM

- Investment Strategy : BUY-BUILD-HOLD

LORGAVEN Apartments @ Modesto, CA

- Asset Category : Residential

- Asset Type : Multifamily

- Investment Type : Common Equity Returns

- Total Lot Size : 3 Acres

- Investment Strategy : BUY-BUILD-HOLD

Project Highlights: Urban Style Class-A, 110 Multifamily apartments designed to be built with contemporary layouts, Eco-friendly, and technology adaptable configurations. Rooftop Solar Panels across the complex for potential reduction in tenant electric bills. Apartments will be installed with High-Speed Fiber Optic cables ready for immediate internet connection.

LORGAVEN Apartments @ Newark Airport, NJ

- Asset Category : Residential

- Asset Type : Multifamily

- Investment Type : Convertible Debt Returns

- Current Market Value : $43.75 MM

- Estimated Total Project Costs : $43.75 MM

- Investment Strategy : BUY-BUILD-HOLD

LORGAVEN Apartments @ Jacksonville Airport

- Asset Category : Residential

- Asset Type : Multifamily

- Investment Type : Convertible Debt Returns

- Estimated Total Project Costs : $43.50 MM

- Investment Strategy : BUY-BUILD-HOLD

Disposed Assets - Sold at 100% return on investment

New Eastlawn Apartments

- Asset Category : Residential

- Asset Type : Multifamily

- Investment Type : Common Equity Returns

- Investment Strategy : BUY-FIX-HOLD

- Purchased Price : $1.25 MM

- Asset Value Appreciation : 92.00%

- Investor Cash-On-Cash Returns : 15.00%

New Forest Park Apartments

- Asset Category : Residential

- Asset Type : Multifamily

- Investment Type : Common Equity Returns

- Investment Strategy : BUY-FIX-HOLD

- Investor Cash-On-Cash Returns : 15.00%

Kensington Manor Apartments

- Asset Category : Residential

- Asset Type : Multifamily

- Investment Type : Common Equity Returns

- Investment Strategy : BUY-FIX-HOLD

- Purchased Price : $4.00 MM

- Sold Price : $8.00 MM

- Investor Cash-On-Cash Returns : 67.00%

Belmont Avenue

- Asset Category : Residential

- Asset Type : Multifamily

- Investment Type : Common Equity Returns

- Investment Strategy : BUY-FIX-FLIP

Scythe Avenue

- Asset Category : Residential

- Asset Type : Single-Family

- Investment Type : Common Equity Returns

- Investment Strategy : BUY-FIX-FLIP